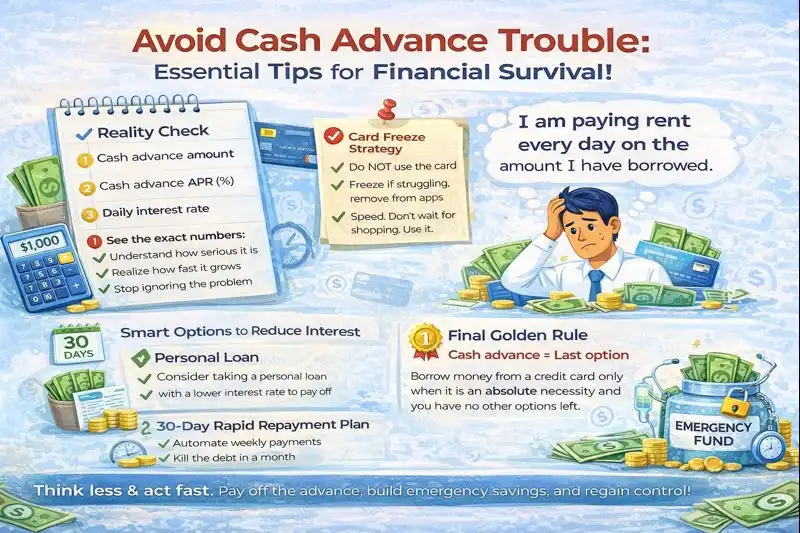

In an emergency, taking a cash advance from a credit card feels easy. But in reality, these advances come with extremely high interest. There is no grace period, the APR is high, and extra fees are always included. Because interest is charged daily, you can quickly lose control as the debt grows.

Before I guide you, I want to share my own story. I got my first credit card about two and a half years ago. At first, I didn’t pay much attention and used it for regular purchases for a few months.

Later, during an emergency, I withdrew $500 as a cash advance. A month later, I paid a “minimum payment” of $100. However, when I checked my next statement, I was shocked. Even though I had paid $100, my remaining balance was still around $480.

At that point, I realised we cannot ignore this problem. We need a clear understanding of how these charges actually work.

Now, I will guide you step by step on how to pay off a credit card cash advance quickly.

Understand why a cash advance is very dangerous

You must clearly understand this before taking a cash advance from a credit card.

- Interest starts on the same day you take the cash advance.

- The interest rate is typically double that of normal credit card purchases.

- An extra 4% to 5% fee is also added immediately.

- Daily compounding interest works like a silent killer, increasing your balance every day.

So, the first rule is: do not ignore this before taking a cash advance from your credit card.

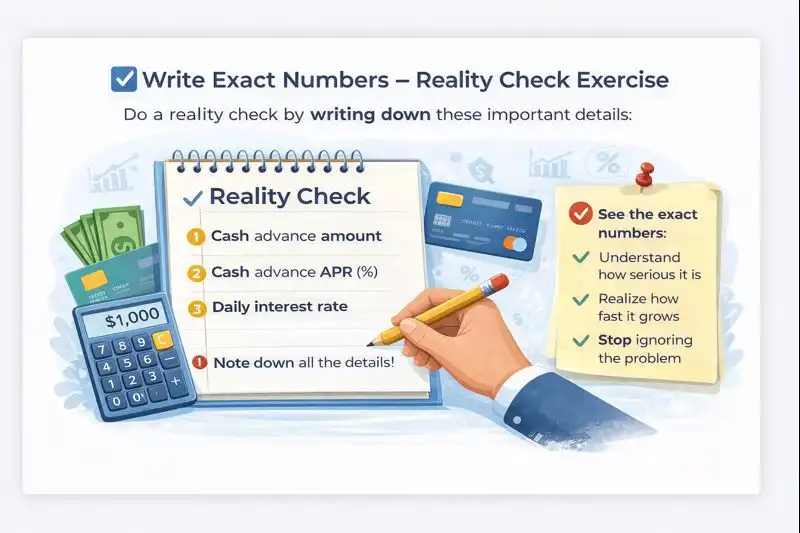

Write exact numbers – reality check exercise

Now, do a reality check by writing down these three very important details:

- Cash advance amount

- Cash advance APR (%)

- Daily interest rate (from your bank statement)

When you write everything clearly, you will start understanding the seriousness of the situation. That is why I strongly recommend noting down all these details. It really helps you understand how serious the problem is and how fast the amount grows.

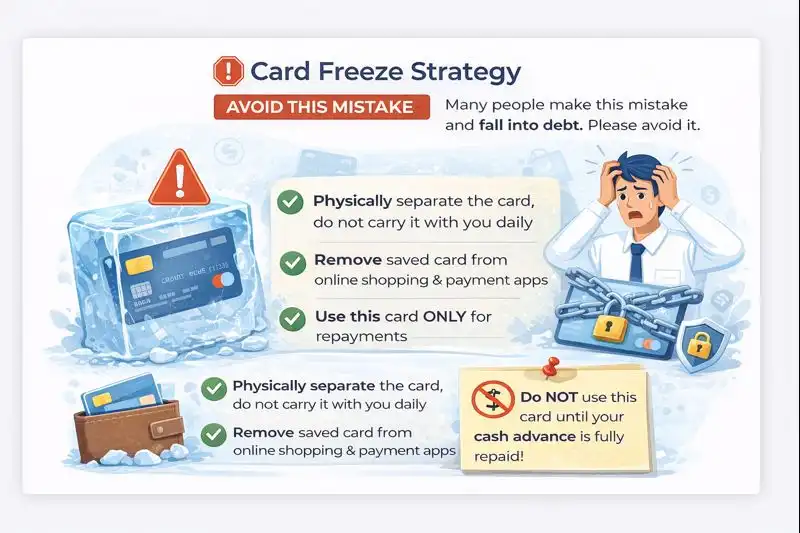

Card freeze strategy (many people make this mistake)

Many people make this mistake, and as a result, they fall into a cycle of debt. Please avoid this mistake.

- Keep the card physically separate and do not carry it daily.

- If the card is already saved on any online shopping or payment apps, I highly recommend removing it immediately.

- Make sure this card is used only for repayment purposes.

Until your cash advance is fully repaid, please avoid using this card. Also, do not purchase anything new before clearing the entire cash advance balance.

Payment allocation rule

This rule is very important to understand.

Minimum payment

You need to know that banks have their own rules for adjusting the minimum payment. It is not in your control to decide how the minimum payment is allocated.

Pay more than the minimum payment

If possible, try to pay a little more every time you make a payment. This extra amount goes directly toward your cash advance.

So, I highly recommend that whenever you pay the minimum amount, you add a little extra. It does not have to be a big amount. Even paying $50 more can make a big difference. In the end, this small extra payment will help you reduce your cash advance much faster.

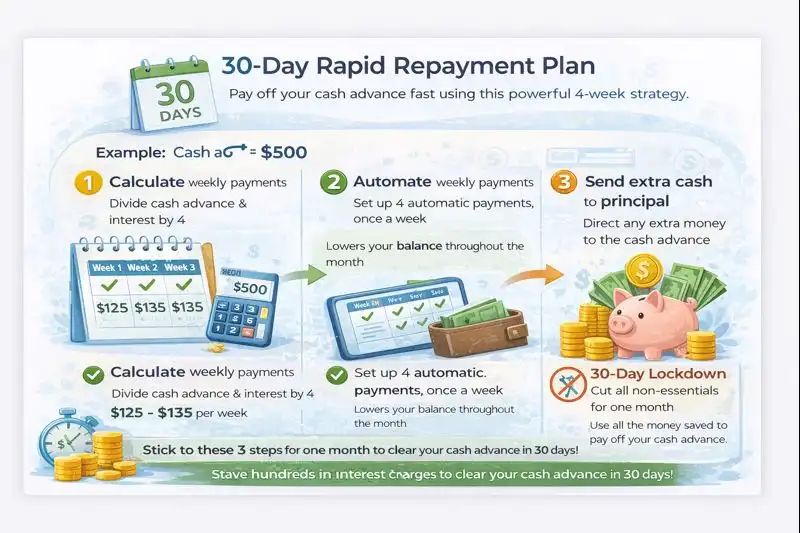

30-Day Rapid Repayment Plan

If your amount is manageable, I will share a very powerful strategy below. This plan will help you reduce your cash advance payment fast.

Example:

Cash advance – $500

Calculate the weekly breakup

First, take your total cash advance and add the estimated interest, then divide it by 4.

For example, if your cash advance is $500, you need to pay around $125 to $135 per week.

By doing this, even a high interest rate of 25% to 30% can be cleared within 30 days.

Automate multiple payments

Instead of making one single payment, make weekly payments, four times a month.

This regular weekly payment reduces your principal faster, and you end up paying less interest because the balance goes down earlier.

Direct extra cash to the principal

Whatever extra money you earn—from a side hustle or any other source—I highly recommend paying it directly toward your cash advance. This helps reduce the balance much faster.

The 30-day lockdown

For one month, stop unnecessary spending like dining out and cancel unused subscriptions.

Whatever amount you save during this period, please use it to pay off the cash advance first.

In the end, if you pay early, you save a lot of interest. You can clear your due balance quickly and protect yourself from extra future charges.

Smart Options to Reduce Interest

If you have a large amount, like $5,000, and are not able to pay it quickly, you can consider the options below.

1. Personal loan

You should try to take a personal loan at the lowest possible interest rate.

If your credit card is charging 35%–42% interest, a personal loan can reduce this to around 10%–15%.

learn more, then click – Financial Protection Bureau – Credit Card Guide

Benefits:

- Fixed EMI: You pay a fixed amount every month, which is easier to manage.

- Lower interest rate: Instead of paying 35%–42% on a credit card, you pay only 10%–15% through a personal loan.

- Settlement of the cash advance: If you take a personal loan equal to your cash advance amount, you can clear the entire cash advance at one time. This helps you save a lot of interest and reduces future financial burden.

2. Balance transfer (with caution)

Many banks offer 0% balance transfer options, such as HDFC Bank and ICICI Bank.

First, call customer care and confirm the offer. If approved, you can transfer your balance and clear your cash advance with less burden. This can save a lot of interest.

Important points:

- 0% Intro APR: Many banks offer 0% interest only for an initial period.

- Transfer fee: Banks may charge a 1%–5% transfer fee, so be aware of this.

- Time limit: After the offer period ends, make sure you clear all dues. Otherwise, heavy charges may be added.

Which is better for you

- If you want a long-term repayment plan, a personal loan is the better option.

- If you want to clear the amount within a few months, a balance transfer can be a good choice.

Emergency Fund Rule – Fix the Root Cause

People take cash advances and loans mainly because they do not have an emergency fund.

If you want to fix the root cause of this problem, I highly recommend starting to save money and building an emergency fund. This helps you avoid borrowing in the future.

Tips to build an emergency fund:

- Create a separate account so you do not accidentally spend this money on daily expenses.

- Use this emergency fund only for real emergencies, such as medical emergencies or urgent and unexpected vehicle repairs. Do not use it for shopping or travel purposes.

Once you build an emergency fund, you will not need cash advances or panic borrowing. This fund gives you financial security and peace of mind.

Psychological Trick (Unique & Rarely Added)

Most people think that whatever money they take needs to be returned, but this thinking is vague. This is the reason we delay payments, and as a result, day by day the interest keeps increasing. After that, people start feeling stressed because they think the debt is never-ending.

But the truth is, instead of thinking about debt like this, think of it this way:

- Instead of saying, “I have borrowed $500,”

- Think, “I am paying rent every day on the amount I have borrowed.”

So, the point is, until you pay the total borrowed amount, think that you are paying rent every day on this amount. This creates a clear cost in your mind, and after that, you can understand the situation clearly and take a clear step toward repayment.

Final Golden Rule (Conclusion Section)

- Cash advance = last option

Borrow money from a credit card only when it is an absolute necessity, and you have no other options left. - Speed

Don’t wait for a perfect plan. Whatever you understand, just do it right now. - Minimum payment is never enough

If you pay only the minimum payment, the debt will never end. - The only goal for extra money: kill the debt

Whatever extra money you get—such as bonuses, gifts, or savings—do not use it for shopping. Use it only to clear your debt.

Simple: Think less and take more action. Use every small amount to clear your debt.

I want to explore more and learn more, then click – How to Pay Off Debt Fast