Debt can feel like a heavy weight. It affects both your present peace of mind and your future goals.

However, the truth is that achieving a debt-free life is not particularly difficult. When you understand how to pay off debt with a clear plan and consistent effort, moving toward financial freedom becomes much more manageable.

I will give you a clear guide and actionable strategies that will help you fight your debt and move toward financial freedom.

Two years ago, I was in the same situation, carrying around $20,000 in debt. I want to share the same practical steps that helped me reduce my debt so that you can apply them in your own life as well.

In this blog, I have shared two proven ways to reduce debt. The first one is a well-known method that many people use to pay off their debt successfully, and I personally followed this method too. Earlier, I felt overwhelmed, just like you might be feeling now.

My entire day was filled with stress and overthinking. Then I created a proper plan and took consistent, actionable steps. That decision helped me reduce and eventually eliminate my debt.

Today, I am living a more peaceful life with better control over my finances.

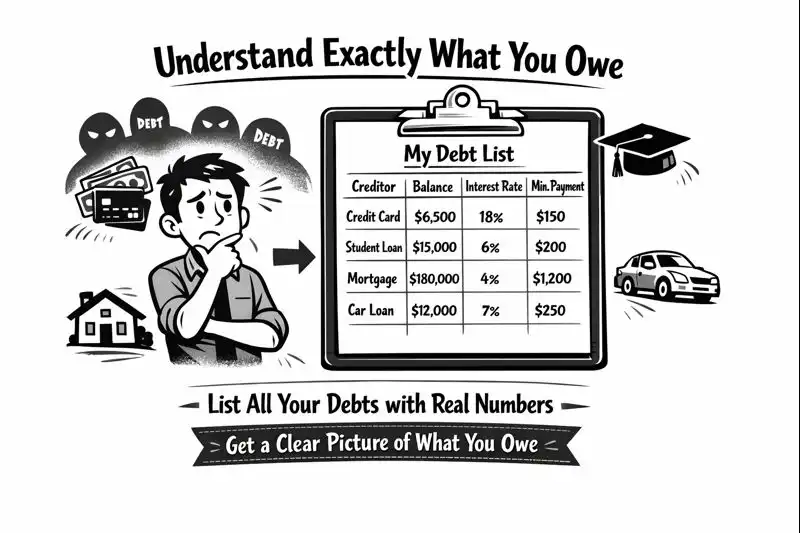

Understand Exactly What You Owe to Pay Off Debt

First of all, you need to understand that you can never defeat an enemy you cannot see.

That is why your first step is to list all your debts instead of guessing. Create a separate list and include every type of loan you have taken, such as credit card debt, student loans, mortgage loans, and any other personal or business loans.

For each debt, write down:

- Creditor name (for example, banks or lenders)

- Current balance owed

- Interest rate (APR)

- Minimum payment required

When you have a clear picture in front of you, the situation starts to feel more manageable because you are working with real data, not assumptions.

To better understand how to pay off debt and how to manage it effectively to improve your financial condition, explore this detailed debt management guide by Investopedia.

Create a realistic budget

For debt repayment and saving money, you need to understand where every single amount of your money is going. A budget is simply a spending plan that records all your income and expenses.

1. Track your income:

Write down all sources of income, including salary, side income, or any extra earnings.

2. Track your expenses:

Review at least your last three months of bank statements and carefully note where your money was spent. While doing this, be honest with yourself.

3. Identify extra money:

Compare your income and expenses to find the difference. This extra amount should be directed toward debt repayment. When you cut back on things like dining out, subscriptions, or daily tea and coffee, it creates more room for faster debt payments.

I am not saying you must completely stop these expenses. The idea is to think about what is possible and realistic for you.

The goal is not to save every single dollar by the end of the month, but to create space in your budget so you can focus on paying off debt faster.

![]()

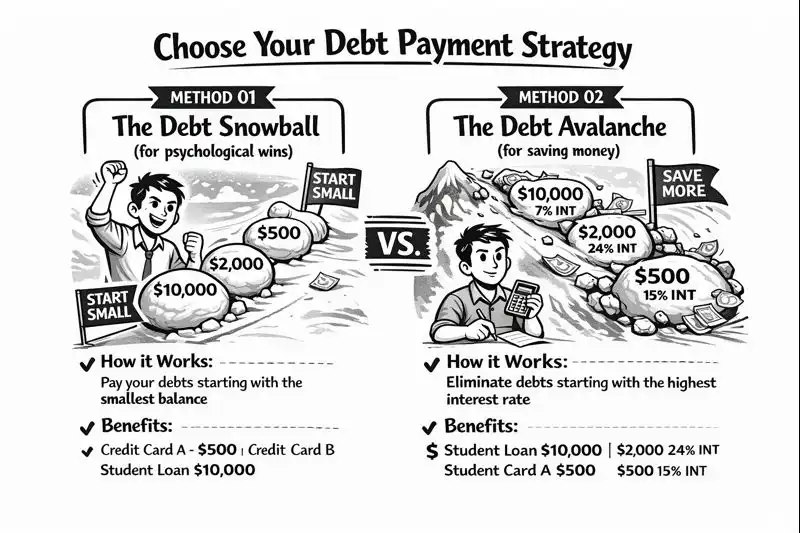

Choose your debt payment strategy

There are two highly effective methods for paying off debt faster, and both work well. You can choose the one that is most suitable for you.

Method 01: The Debt Snowball (for psychological wins)

This method is very popular because it focuses on motivation and small wins.

How it works:

You pay off your debts from the smallest balance to the largest balance, while continuing to make minimum payments on all other debts.

Benefits:

When you pay off your smallest debt first, it gives you a psychological boost. This motivation helps you stay consistent and confident as you move on to larger debts.

Example:

- Credit card A – $500

- Credit card B – $2,000

- Student loan – $10,000

If you pay off the smallest debt of $500 first, your mind feels relaxed and encouraged. This positive feeling prepares you to tackle the next debt of $2,000. This is how the snowball method builds momentum over time.

Method 02: The Debt Avalanche (for saving money)

This method is ideal for individuals who are number-oriented and seek to maximise their savings on interest.

How it works:

You focus on paying off debts with the highest interest rate first, while making minimum payments on the rest.

Benefits:

By eliminating the most expensive debt first, you pay less interest over time. This helps you save more money and reduce the total cost of your debt.

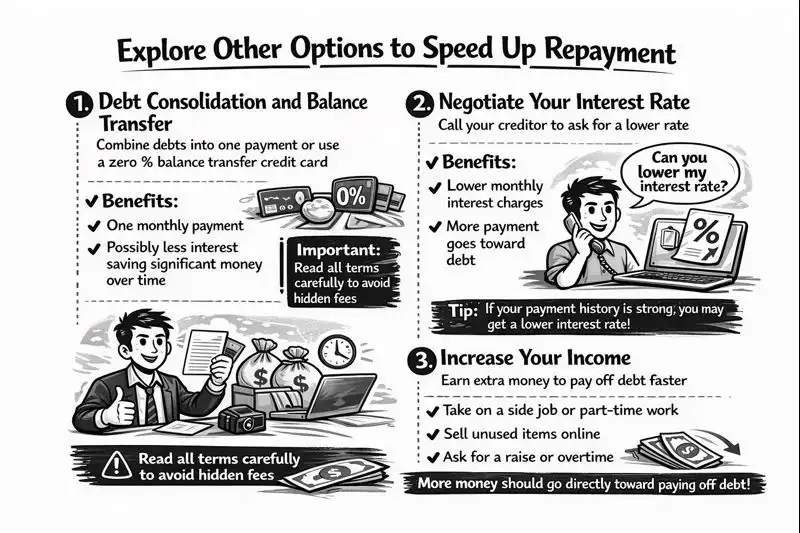

Explore Other Options to Speed Up Repayment

1. Debt consolidation and balance transfer

If you have multiple credit cards or loans, you can consider combining them into one payment through debt consolidation. Another option is using a zero-per cent balance transfer credit card.

Benefits:

- You only need to remember one monthly payment.

- You may pay less interest, which can save you a significant amount of money over time.

Important things to check before taking action:

- Some credit cards may have hidden fees or balance transfer processing charges, so read all terms carefully.

- After the zero-per-cent balance transfer period ends, lenders often increase the interest rate. Make sure you understand what the new rate will be.

Before choosing this option, ensure that everything is clear from the beginning so there are no surprises later.

2. Negotiate your interest rate

Many people do not know that you can call your credit card company and ask for a lower interest rate. If you explain that you always pay your dues on time, they may be willing to reduce it.

Benefits:

- Lower monthly interest charges

- More of your payment goes toward reducing the actual debt

Tip:

If your payment history is strong, there is a high chance that the credit card company may offer you a lower interest rate.

3. Increase your income

When you earn even a small extra amount, it can reduce your debt much faster. You can increase your income in several ways:

- Take up a part-time job or a side hustle.

- Increase your current income through a salary raise or overtime work.

- Sell unused items from your home through online platforms.

The most important thing is how you use this extra income. Whatever additional money you earn should go directly toward paying off your debt, not toward personal spending or lifestyle upgrades.

A simple rule: lower interest rates and higher income lead to a debt-free and peaceful life.

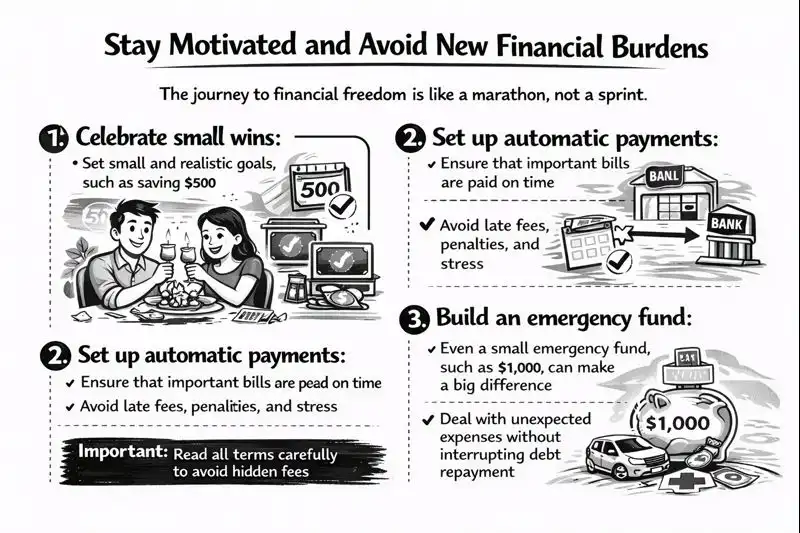

Stay motivated and avoid new financial burdens

The journey to financial freedom is like a marathon, not a sprint.

1. Celebrate small wins:

Set small and realistic goals, such as saving $500. Stay consistent and track your progress. When you reach your goal, reward yourself with a budget-friendly treat, like a special dinner at home or a low-cost movie night. The reward should motivate you, not create new expenses.

2. Set up automatic payments:

Automatic payments ensure that your important bills are paid on time without missing deadlines. This reduces the risk of late fees, penalties, and stress, and helps your debt repayment stay consistent.

3. Build an emergency fund:

Even a small emergency fund, such as $1,000, can make a big difference. This fund helps you handle unexpected expenses like vehicle repairs or medical emergencies without interrupting your debt repayment plan.

Conclusion:

Taking control of your debt through a clear financial plan is a powerful step toward overall well-being. Without a proper and structured plan, it becomes very difficult to reduce debt faster. This journey requires planning, consistent action, and discipline.

By following these steps, you can learn how to pay off debt in a realistic and stress-free way. As a final reminder, try to avoid taking on new debt in the future.

Start today by writing down your debts, creating a plan, and working on it step by step. These small actions can greatly reduce tomorrow’s stress and help you build a calmer and more secure future.

If you have student loans, check out this blog where I clearly and thoroughly explain how to pay off student loan debt faster. – 15 Proven Ways to Pay Off Student Loan Debt Faster in 2025